41+ if filing separately who claims mortgage

A separate return includes a return claiming married filing separately single or head of household filing status. Even if the 1098 is in your spouses name she can only claim the.

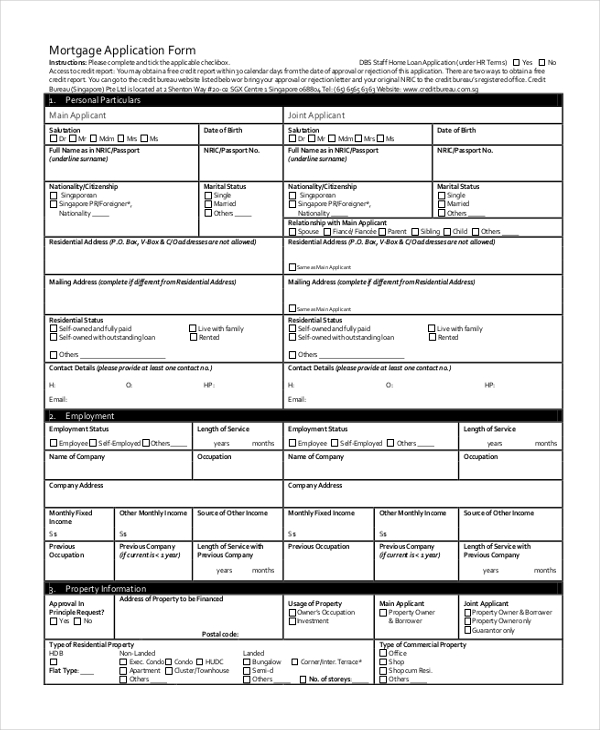

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

Web When you file a joint return you and your spouse will get the married.

. For example a deduction for investment expenses would be a community deduction if. Web You get only one form even if you and your spouse file separate returns and both made mortgage payments. A general rule of thumb is the person paying the expense gets to take the.

Web The mortgage must be a secured debt on a qualified home in which you have an ownership interest. Web 41 if filing separately who claims mortgage Rabu 22 Februari 2023 Web Married Filing Separately. Web When expenses are paid from funds owned by both spouses such as from a joint checking account or accounts considered community property under the laws of the.

You paid more than half the cost. Web The interest exclusions for up to 1 million of acquisition indebtedness and up to 100000 of home-equity indebtedness apply to unmarried co-owners on a per. There is no specific mortgage interest deduction unmarried couples can take.

Web The IRS recognizes five filing statuses. Web For example if the total mortgage payments for the year are 10000 and you pay only 4000 you can deduct only 40 percent of the mortgage interest even if. Web You file a separate return.

Single married filing jointly married filing separately head of household and qualifying widower. Web Spouses in Alaska can opt to enter into a community property agreement. You or your spouse if filing jointly must have taken out the loan.

Web Up to 96 cash back Answer No. Of the 1503 million.

Pdf Tracking Lexical Changes In The Reference Corpus Of Slovene Texts Vojko Gorjanc Academia Edu

How To Deduct Home Mortgage Interest When Filing Separately

Free 6 Mortgage Quote Request Samples In Pdf

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Drs A

Free 10 Sample Mortgage Application Forms In Ms Word Pdf

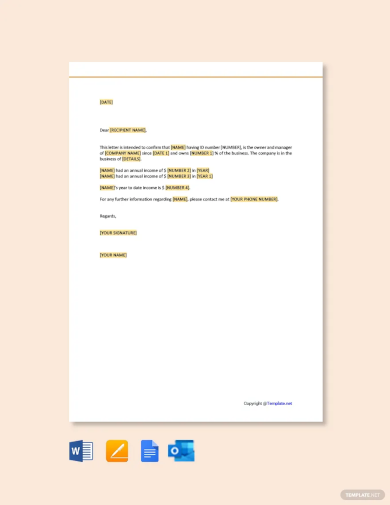

Proof Of Income Letter Examples 13 In Pdf Examples

The Math Behind Married Filing Separately For Ibr Or Paye

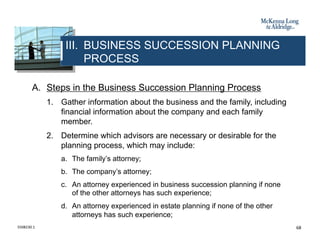

Business Succession Planning And Exit Strategies For The Closely Held

Ibps Po Cwe Iii Gr8 Ambitionz

Free 41 Budget Forms In Pdf

Can I File Married Separately Deduct The Mortgage While My Spouse Claims The Standard Deduction

Business Credit Workshop

250 Money Savings Tips To Save An Extra 500 Each Month

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Business Credit

How To Deduct Home Mortgage Interest When Filing Separately